- Save

-

-

What Are You Saving For?

We all know how important saving money is. Whether you’re a dedicated saver or just beginning to build your savings; we offer a variety of safe and secure savings plans to help your money grow.

-

Savings Accounts

-

Open an Account Online

When you join AMOCO Federal Credit Union you begin your membership by opening a basic savings. This account establishes your ownership in the credit union and is the foundation you can build on to achieve your financial goals.

-

-

- Spend

-

-

What Are You Spending For?

Spending money is an essential part of everyday life, but smart spending can bring you true financial peace of mind. At AMOCO, we offer a variety of checking products designed to provide convenience and flexibility, money-saving benefits, and opportunities to earn interest.

-

Spend Accounts

-

Want Affordable Checking?

We offer a variety of Checking Accounts to fit your needs, whether you’re looking for money-saving perks, no monthly fees, easy access to funds, or interest-earning options, all providing you with flexibility and convenience.

-

-

- Borrow

-

-

What Are You Borrowing For?

Our goal to make your financial dreams come true. Whether you are purchasing your first car, looking for a great credit card or want to own vacation homes, we help you fund your future.

-

Loans

-

Apply for a Loan Online

At AMOCO, we have loans for your wants and needs. We work hard to provide members with high-quality service, lower rates, and flexible payment options so you can get the most for your money.

-

-

- Insure

-

-

Protect What Matters!

Prepare for the unexpected. Our insurance plans can help you save big while offering excellent coverage. Don’t wait until it’s too late – contact us today to learn more about your options.

-

Insurance

-

Explore Coverage Plans

We’ve broadened our insurance offerings by partnering with reputable organizations. Let us help you find the coverage you need for the things that matter most to you. And the best part? You can potentially save hundreds of dollars annually.

-

-

- Invest

-

-

Invest In Yourself!

Plan our financial dreams – from saving for college to planning retirement. We’ll discover where you want to go and how you will get there.

-

Start Investing

-

Manage Your Investments

Through LPL Financial, you have the ability to manage multiple types of investments, access your account anywhere, anytime and partner with a professional to help understand your unique financial situation.

-

-

- Business

-

-

Ready to Take Your Business to New Heights?

Unlock the full potential of your business with our business account options! Our business accounts provide comprehensive

solutions for managing finances efficiently and effectively.

-

Business Accounts

-

Business Savings Account

Our Business Savings Account provides entrepreneurs a secure place to store operating capital, and save for business related purchases. With as little as $1, you can open a business savings account with AMOCO and start your financial foundation.

-

-

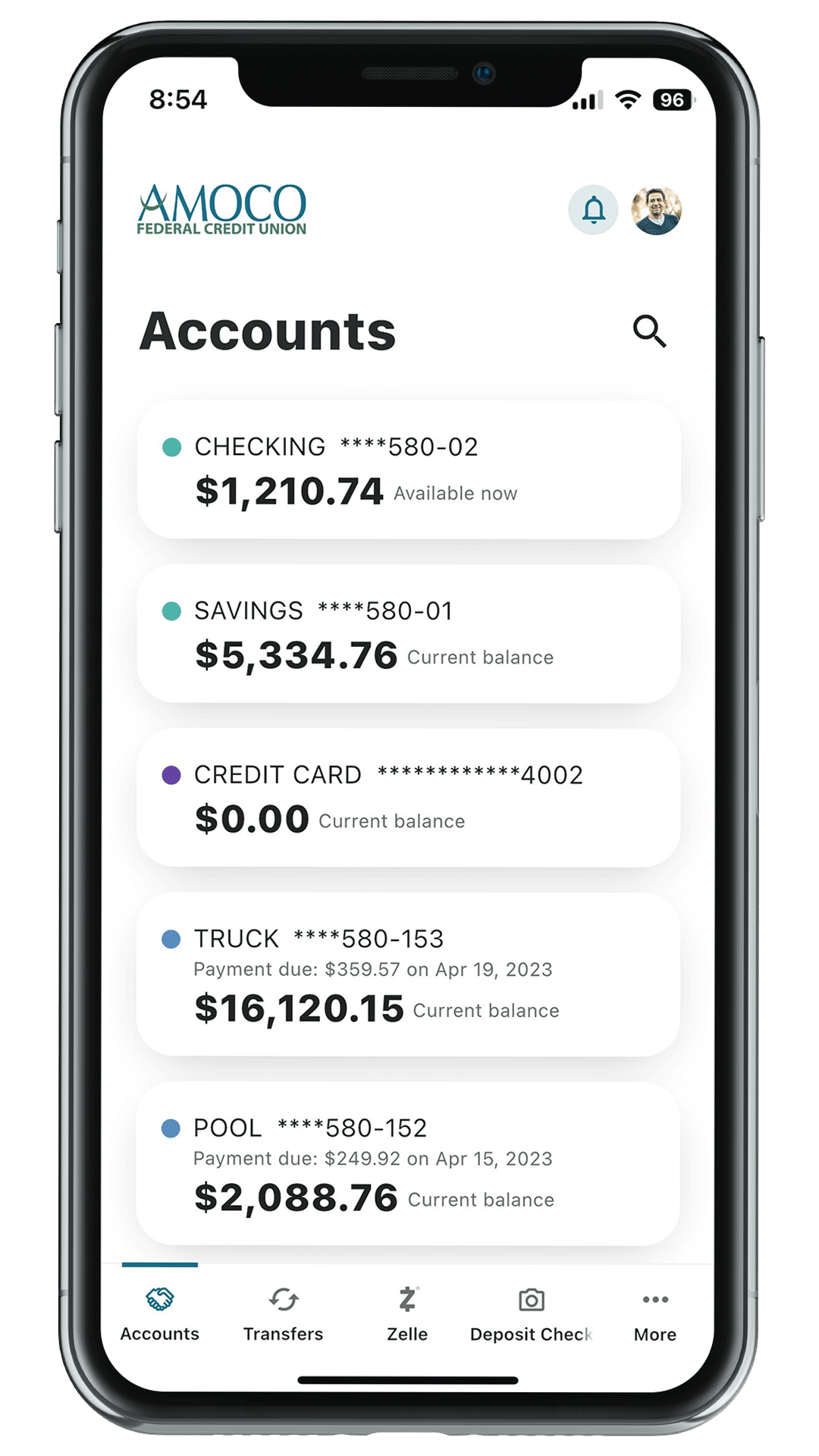

- ACCESS MY ACCOUNT

Mobile Banking at your fingertips.

Wherever your day takes you, your accounts are just a tap and click away with the AMOCO Mobile App. Check out some of our App’s favorite features below. Ready to get started? Download our free App now.

AMOCO Mobile App

NEW! Debit Card Controls

Take card management to the next level with controls and alerts on your AMOCO Debit Card and safeguard your account against fraud.

Custom Account Alerts

What's this $200 withdrawal? Setup custom alerts sent to your phone or email.

Face & Touch Login

Make transactions easy and secure with Face ID, Touch ID, and Fingerprint Authentication (if supported).

Skip-A-Pay

Everyone could use extra funds from time to time, and with our convenient Skip-A-Pay you can instantly take a break from your qualifying loan payment(s) up to two times a year.

Deposit Check(s)

Deposit checks with your mobile device just by taking a picture. You're going to love this feature!

Personal Info & Documents

Stay connected with us and update your personal info on-the-go and access up to 18 months of eStatements.

By Using Our Mobile App You Can Conveniently:

- View posted and pending transactions

- Make loan and credit card payments

- Link accounts from other banks

- Deposit your check(s), endorse with “for mobile deposit only”

- Skip your loan payment with Skip-A-Pay

- Control your Debit Card in real time with our Card Controls

- Check account balances

- Manage all of your accounts with one login

- Transfer funds between your accounts and to other members

- Pay bills electronically

- Get your credit score through Credit IQ Powered by SavvyMoney

Let's Get Started

How to Register for Mobile Banking

Step 1: Download our mobile app from the “Google Play” or the “Apply App Store,” and access our app.

Step 2: Open the app then tap “Register a New Account.”

Step 3: Read the Digital Banking Disclosure and accept the agreement by checking the “I Agree” box, then tap “Continue.”

Step 4: Confirm Your Identity by providing your Birth Date, Social Security or Tax ID Number, and Member Number, then tap “Continue.”

Step 5: Verify your identity using the SMS Text or Voice Call option, then “Continue.”

Step 6: Enter the 6-digit code provided, then tap “Verify.”

Step 7: Enter a username and then click “Create Username.”

Tips:

- Do not use personal information for a username, such as your member number, any part of your birthday, or SSN.

- As much as we are flattered, do not use usernames such as “amocoacct.”

- Do not use symbols (@#$%&* etc) in the username.

- Usernames must be unique, at least 6 characters long, no more than 30 characters, and alphanumeric.

Step 8: Enter a safe password and then click “Create Password.”

Tips:

- Use a strong password with more than 6 characters.

- Use upper and lower case characters.

- Use numbers and symbols (@#$%&* etc).

- Keep your passwords safe.

Step 9: Use your new username and password, then tap “Log in.”

Step 10: Review your contact information and then click “Continue.”

You’re all set!

Online Banking/Mobile App FAQs

The answers you need to the questions you have.

Online Banking:

- To register for Online Banking, please click ‘Access My Account.’Click ‘Register here.’

- Agree to the terms and conditions.

- Confirm your identity by entering your birth date, SSN/Tax ID number, and member number that will be provided to you when you open an account and click ‘Continue.’

- Complete the prompts to confirm your information.

- Done! Start banking, and you can take AMOCO whenever, wherever, by downloading the Mobile App.

Mobile App:

- Download the AMOCO App.

- Click ‘Sign up now’.

- Enter your birth date, SSN/Tax ID, and your member number that will be provided to you upon account opening.

- Complete the prompts to confirm your information.

- Done! Start banking.

- Birth Date

- SSN/TaxID

- Member Number

Please contact our Call Center at 800.231.6053 speak to a live representative through Video Banking to receive your AMOCO and we can help you. To complete electronic transactions or to set up direct deposit, please use your complete ten-digit account number.

You are eligible to use Mobile Deposit if you are 18 years of age or older or if allowed by parental guidance.

- Write your account number and if it’s going to your savings or checking on the back of the check.

- Your signature on the signature line.

- Write on the back of the check(s) “For Mobile Deposit Only” underneath the signature line.

Your check(s) will not be accepted for deposit if it does not contain your endorsement as noted above. In this situation, you will be notified that the item was rejected. In the event the check is rejected, you will be notified so you can resubmit.

You can make deposits into your savings or checking account.

The following items cannot be deposited:

- Cash

- Checks payable to any person or entity other than yourself

- Checks that are stale dated or postdated

- U.S. Savings Bonds

- Previously returned checks

- Checks payable to yourself and another party who is not a Joint Owner on the account

- Foreign Checks

- Checks that have been altered

- US Treasury or Republic checks are not accepted through Mobile Deposit and must be presented in-branch for additional security purposes.

If you forgot your username, you can click ‘Forgot Username’ on our mobile app or on our website. You will need to provide the following to recover it:

- Birth Date

- Social Security Number

- Member Number

Once you enter the above credentials, your username will be given to you.

If you are still having issues logging in, you can call us: 800.231.6053, speak to a live representative through Video Banking or send us a Let’s Talk request from our homepage.

If you forgot your password, you can click ‘Forgot Password’ on our mobile app or on our website. You will need to provide the following to recover it:

- Online Banking Username

- Birth Date

- Social Security Number

Once you enter the above credentials, you will be given an option of where to send your temporary password (email or text).

If you are still having issues logging in, you can call us: 800.231.6053, speak to a live representative through Video Banking or send us a Let’s Talk request from our homepage.

Online Banking:

- Click the ‘Money Movement’ tab and select ‘Make a Transfer’

- Click the ‘Classic’ tab in Online Banking and then click ‘Add an account to make a transfer’

- Select ‘Add an account instantly’

- Select your financial institution

- Sign in with the credentials you use for your external account

By providing your credentials, we can verify in real-time that you own that account you want to link. We then use this information to establish a secure connection with your financial institution.

Mobile Banking:

- Click the ‘Transfers’ tab in mobile banking

- Click ‘Add Account’ then select ‘Add an account instantly’

- Select your financial institution

- Sign in with the credentials you use for your external account

By providing your credentials, we can verify in real-time that you own that account you want to link. We then use this information to establish a secure connection with your financial institution.

Please follow the tips below to help make the check submission go smoothly.

- Write on the back of the check(s) “For Mobile Deposit Only.”

- Make sure that all four corners of the check are in the photo.

- Take the picture of the check in good lighting and try to avoid having shadows on the check.

- Make sure the photo is not blurry, and everything is legible.

- The picture of the check should be taken on a flat surface, preferably with a dark background so you can see the edges of the check.

- The only thing in the photo should be the check. There should be nothing in the background.

- If your check is wrinkled, try to smooth it out as much as possible.

The limit amount to deposit is $50,000 per day per deposit and $100,000 every 30 days.

After receiving confirmation that the deposit was accepted, please store your check in a safe place for up to 30 days or until the deposit appears on your monthly statement. Then, securely discard the check and/or clearly mark the check as “VOID” if you wish to keep it for your records.

Also, be on the lookout for our upcoming Shred Day events to securely shred your unwanted documents for free.

Online Banking:

- Click the ‘Money Movement’ tab and select ‘Make a Transfer’

- Click the ‘Classic’ tab in Online Banking and then click ‘Add an account to make a transfer’

- Select ‘Send money to another AMOCO member’

- Enter the recipients Last Name, Account type, Member Number, and then Account or Loan Number. For the Account Number, enter the two to three digital account number you would like to transfer to.

Ex. Enter an 01 for #1 Savings, or 02 for #2 Checking. We will send an email to the recipient notifying them of this connection, if possible.

Mobile App:

- Click the ‘Transfers’ tab in mobile banking

- Click ‘Add Account’ then select ‘Send money to another AMOCO member’

- Enter the recipients Last Name, Account type, Member Number, and then Account or Loan Number. For the Account Number, enter the two to three digital account number you would like to transfer to.

Ex. Enter an 01 for #1 Savings, or 02 for #2 Checking. We will send an email to the recipient notifying them of this connection, if possible.

To access your online statements, please follow these steps:

Online Banking:

- Sign in to Online Banking

- Click on the ‘Resources’ tab

- Select eStatements

- Click on ‘Statements’ tab and then click ‘View Statements’ button

Mobile Banking:

- Sign in to Mobile Banking

- Select the ‘More’ menu option

- Click on ‘Resources’

- Select ‘eStatements’

- Click on ‘Statements’ and then click ‘View Statements’ button

To access Bill Pay, please follow these steps:

Online Banking:

Sign in to Online Banking

- Click on the ‘Money Movement’ tab

- Select ‘Bill Pay’

- Click the ‘Launch Bill Pay’ button

- Select ‘Business’ or ‘Person’

Mobile Banking:

- Sign in to Mobile Banking

- Select the ‘More’ menu option

- Click on the ‘Money Movement’ tab

- Select ‘Bill Pay’

- Click the ‘Launch Bill Pay’ button

- Select ‘Business’ or ‘Person’

Take care of your bills in three easy steps:

- Pick a bill you want to pay

- Enter the info from your bill

- Choose how much and when

Online Banking:

- Click the ‘More’ Tab

- Click the ‘Settings’ tab in Online Banking and then click ‘Contact’

- Click on the pencil icon to update your address and/or phone number

Mobile App:

- Click on the drop-down tab in Mobile Banking

- Click the ‘Settings’ tab and then click ‘Contact’

- Click on the arrow to update your address and/or phone number

Yes, AMOCO’s Online Banking has Account Alerts.

Online Banking:

- Sign in to Online Banking

- Click on the ‘Resources’ tab

- Select ‘Alerts’

Mobile Banking:

- Sign in to Mobile Banking

- Select the ‘More’ menu option

- Click on ‘Resources’

- Select ‘Alerts’

There are many notifications you can set up with various rules. Just select the alert you wish to set, switch the toggle on, and choose the method of how to be alerted, and save!

Please note: Only eBranch login and initiated transfer alerts are instant. Other alerts are not instant and will be sent out throughout the day.

Credit Cards will be available only to the primary member of your membership through the AMOCO eBranch. Joint cardholders may register at this link to view credit card information and make payments.

Yes, under the Account section you can look up your Tax information, under the Tax Information tab. However, 1099 Forms are not available.

Yes, our new eBranch supports file downloads for major finance management software, such as Quicken, Mint, etc. We also support Quick WebConnect, which allows users to add and sync accounts directly within Quicken.

You may download by clicking the download icon on your Account Details screen after choosing an account from your dashboard.