- Save

-

-

What Are You Saving For?

We all know how important saving money is. Whether you’re a dedicated saver or just beginning to build your savings; we offer a variety of safe and secure savings plans to help your money grow.

-

Savings Accounts

-

Open an Account Online

When you join AMOCO Federal Credit Union you begin your membership by opening a basic savings. This account establishes your ownership in the credit union and is the foundation you can build on to achieve your financial goals.

-

-

- Spend

-

-

What Are You Spending For?

Spending money is an essential part of everyday life, but smart spending can bring you true financial peace of mind. At AMOCO, we offer a variety of checking products designed to provide convenience and flexibility, money-saving benefits, and opportunities to earn interest.

-

Spend Accounts

-

Want Affordable Checking?

We offer a variety of Checking Accounts to fit your needs, whether you’re looking for money-saving perks, no monthly fees, easy access to funds, or interest-earning options, all providing you with flexibility and convenience.

-

-

- Borrow

-

-

What Are You Borrowing For?

Our goal to make your financial dreams come true. Whether you are purchasing your first car, looking for a great credit card or want to own vacation homes, we help you fund your future.

-

Loans

-

Apply for a Loan Online

At AMOCO, we have loans for your wants and needs. We work hard to provide members with high-quality service, lower rates, and flexible payment options so you can get the most for your money.

-

-

- Insure

-

-

Protect What Matters!

Prepare for the unexpected. Our insurance plans can help you save big while offering excellent coverage. Don’t wait until it’s too late – contact us today to learn more about your options.

-

Insurance

-

Explore Coverage Plans

We’ve broadened our insurance offerings by partnering with reputable organizations. Let us help you find the coverage you need for the things that matter most to you. And the best part? You can potentially save hundreds of dollars annually.

-

-

- Invest

-

-

Invest In Yourself!

Plan our financial dreams – from saving for college to planning retirement. We’ll discover where you want to go and how you will get there.

-

Start Investing

-

Manage Your Investments

Through LPL Financial, you have the ability to manage multiple types of investments, access your account anywhere, anytime and partner with a professional to help understand your unique financial situation.

-

-

- Business

-

-

Ready to Take Your Business to New Heights?

Unlock the full potential of your business with our business account options! Our business accounts provide comprehensive

solutions for managing finances efficiently and effectively.

-

Business Accounts

-

Business Savings Account

Our Business Savings Account provides entrepreneurs a secure place to store operating capital, and save for business related purchases. With as little as $1, you can open a business savings account with AMOCO and start your financial foundation.

-

-

- ACCESS MY ACCOUNT

Financial Tools

We believe in empowering our members in their financial journey and providing knowledge to keep you financially strong. We provide an array of useful tips and planning resources free of charge.

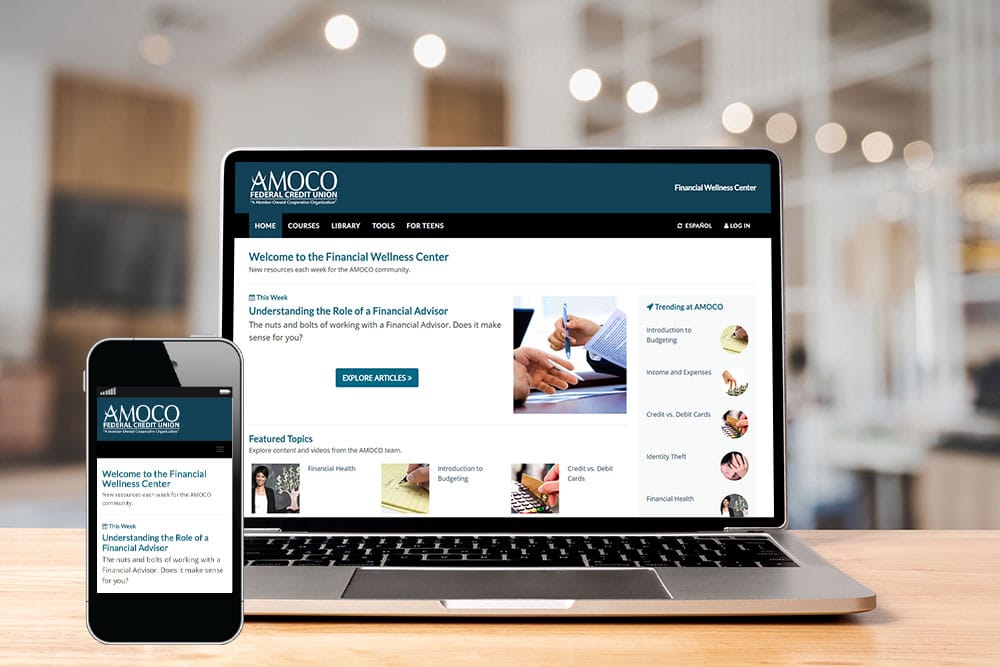

Financial Wellness Education

MoneyEdu

Empower Your Financial Journey

AMOCO has partnered with MoneyEdu to provide free, online financial education through interactive and self-paced courses, activities and worksheets giving members and the community access to financial education. In addition, if you create an account, you can save your progress and never lose your work.

- New themes every week

- Featured resources

- Calculators and assessments

- Interactive courses on over dozens of topics

- Create a portfolio of your goals and achievements

Protect Yourself

The piercing ring of the telephone interrupts your dinner – an authoritative yet friendly voice on the other end explains that your Social Security number has been compromised and your checking account has been frozen. As the caller rattles off the last few digits, panic sets in. They request personal information to “resolve this issue” and restore your account.

What should you do?

Financial scams come in many forms, and they often start with a call, text, or email that looks like it came from your financial institution, but it didn’t. Criminals abuse the trust we have in our institutions to scam us out of not only money but also personal information that can be used for identity theft.

And in addition to scams related to your financial services provider, other imposter scams can prey on family relationships or even something as routine as getting technical support for your devices. For example, family emergency scams often target the elderly with calls that impersonate a family member or friend needing money urgently. They will spin an elaborate story about being arrested, having a car breakdown or needing medical treatment in another country.

Technical support scams involve a scammer posing as a tech support representative from a well-known company. They might call warning that your computer has been infected, or a popup may appear on your computer screen warning of a virus. The scammer then instructs you to provide remote access to your computer so they can fix the issue, which gives them access to personal information.

Of course, there are many types of financial scams not covered here, but they often share similar techniques and calls to action.

Identifying Scams

The first step to protecting yourself from impersonation scammers is to identify common scam techniques, including the persuasive triggers they use to get you to act – often quickly and without thinking through the situation.

Expert imposters will know some of your details, using that familiarity to build trust. Less sophisticated scammers may simply send a text in the name of your financial institution with a link to “verify your account.” Either way, once provided access, they can drain your accounts and wreak havoc with your stolen identity.

To potentially identify scammers who call you, consider these tips:

Be Skeptical – Always approach unsolicited calls with skepticism, especially if the caller asks for personal or financial information or demands immediate payment.

Don’t Trust Caller ID – Scammers are very good at spoofing official numbers and local area codes to gain your trust quickly.

Verify Caller Identity – If a caller claims to represent a specific organization or government agency, hang up and contact that entity directly using a phone number from their official website or your account statement, not the number provided by the caller. The same goes for AMOCO. Hang up and call our direct phone number located on our website.

Check for Urgency – Scammers often create a sense of urgency to pressure you into making decisions in a rush. They might say you must confirm your identity, update your information, or claim a prize quickly.

Be Aware of Threats – Scammers often use threats of arrest, lawsuit, account closure, or similar dire consequences. Genuine agencies do not operate this way and will usually contact you by mail first.

In addition to calls, fraudulent texts and emails are also common. To help identify these scams:

Be Wary of Unsolicited Communications – Approach unsolicited texts and emails cautiously, especially those that ask for personal or financial information or require immediate action. AMOCO will never contact you to request any sensitive account or personal information.

Avoid Clicking on Links – Don’t click on any links or download attachments from suspicious emails or texts. The links may lead to fraudulent websites or contain malware. If you receive a link from a sender claiming to be AMOCO, disregard it and contact us directly.

Doublecheck the Sender’s Email Address – Scammers often use addresses or numbers that appear similar to legitimate ones with minor alterations.

Examine the Message’s Tone – Be cautious of messages that convey a sense of urgency, threats, or high-pressure tactics to push you into immediate action.

Hover Over Links – If using a computer, hover your mouse over any link included in emails (without clicking) to preview the URL. Remember, the URL you see in an email may not be the actual address. Otherwise, avoid visiting suspicious links.

How to Protect Yourself

If you suspect someone is trying to scam you, here are some tips:

Contact the Company Directly – If you need clarification on a message’s legitimacy, contact the company directly using verified contact details from their official website or your account statements, not the contact details provided in the suspicious message.

Don’t Share Sensitive Information – Never respond to texts or emails requesting personal or financial information. And only reveal personal data if you make the call to a verified phone number.

Never Deposit Money to “Correct” an Error – A legitimate financial institution will never ask you to purchase gift cards or deposit money into a Bitcoin ATM to correct errors with your account.

Use Multi-Factor Authentication – Enable multi-factor authentication on your accounts. This adds an extra layer of security by requiring at least two forms of identification before granting access.

Review Bank and Credit Card Statements – Regularly review your bank and credit card statements to identify any unauthorized or suspicious transactions. Consider transaction notifications, credit freezes, and fraud alerts to protect accounts.

Maintain Privacy – Be mindful of sharing your phone number (as well as address, birth date, and other personal information) on social media or in online forms. The more private you keep your number, the less likely you are to receive unsolicited calls and texts.

These tips only include some ways to protect yourself, and scammers are continually changing tactics, so seeking continual education on protecting yourself is critical.

The Takeaway

Awareness represents the first line of defense. While the specific scams may change, the red flags signaling suspicious activity have largely remained constant. Watch for urgent demands, requests for unusual payment types, threats, and contacts from suspicious phone numbers or email addresses.

Trust your instincts if a call or email seems suspicious, take your time to confirm identities, and avoid ever providing personal information to an unverified source. And don’t hesitate to end communication with anyone pressuring you to take immediate financial action.

Remember: AMOCO will never directly contact you to ask for sensitive account or personal information, whether by phone, social media, text, email or mail. Our top priority has been and always will be to keep your financial and personal information secure and confidential. If you receive a suspicious fraud message (text, email, phone call, or mail) claiming to be from AMOCO, please do not respond nor share your account information or password credentials. If you feel you have been a victim of fraudulent activity, please contact us directly.

Copyright © 2024 Decision Partners LLC. All rights reserved.

Financial Tools

Auto Loan

Calculator

Want to know how much your new auto loan will cost you? Curious if your budget can afford the new car you’ve been eyeing? Use our Auto Loan Calculator today!

Financial Wellness Center

Access additional personal finance articles and tools through our partner program, MoneyEdu. When you register for a FREE profile, you’ll also receive free financial wellness courses and calculators.

Budget

Calculator

Making a budget and sticking to it is the number one step to having financial freedom. Use this calculator to help you create a monthly budget by entering your monthly take-home pay.