- Save

-

-

What Are You Saving For?

We all know how important saving money is. Whether you’re a dedicated saver or just beginning to build your savings; we offer a variety of safe and secure savings plans to help your money grow.

-

Savings Accounts

-

Open an Account Online

When you join AMOCO Federal Credit Union you begin your membership by opening a basic savings. This account establishes your ownership in the credit union and is the foundation you can build on to achieve your financial goals.

-

-

- Spend

-

-

What Are You Spending For?

Spending money is a daily part of living; however, smart spending allows you to save for your future. At AMOCO, we believe in investing in you and helping you build your nest egg to take care of yourself and your family.

-

Spend Accounts

-

Want Affordable Checking?

We believe that checking should be made simple, so we have one FREE checking account for all of our members. That’s right, no minimum balance requirements, no direct deposit requirements, no monthly service fee and unlimited transactions!

-

-

- Borrow

-

-

What Are You Borrowing For?

Our goal to make your financial dreams come true. Whether you are purchasing your first car, looking for a great credit card or want to own vacation homes, we help you fund your future.

-

Loans

-

Apply for a Loan Online

At AMOCO, we have loans for your wants and needs. We work hard to provide members with high-quality service, lower rates, and flexible payment options so you can get the most for your money.

-

-

- Insure

-

-

Protect What Matters!

Prepare for the unexpected. Our insurance plans can help you save big while offering excellent coverage. Don’t wait until it’s too late – contact us today to learn more about your options.

-

Insurance

-

Explore Coverage Plans

We’ve broadened our insurance offerings by partnering with reputable organizations. Let us help you find the coverage you need for the things that matter most to you. And the best part? You can potentially save hundreds of dollars annually.

-

-

- Invest

-

-

Invest In Yourself!

Plan our financial dreams – from saving for college to planning retirement. We’ll discover where you want to go and how you will get there.

-

Start Investing

-

Manage Your Investments

Through LPL Financial, you have the ability to manage multiple types of investments, access your account anywhere, anytime and partner with a professional to help understand your unique financial situation.

-

-

- ACCESS MY ACCOUNT

- Special Offers

Financial Tools

We believe in empowering our members in their financial journey and providing knowledge to keep you financially strong. We provide an array of useful tips and planning resources free of charge.

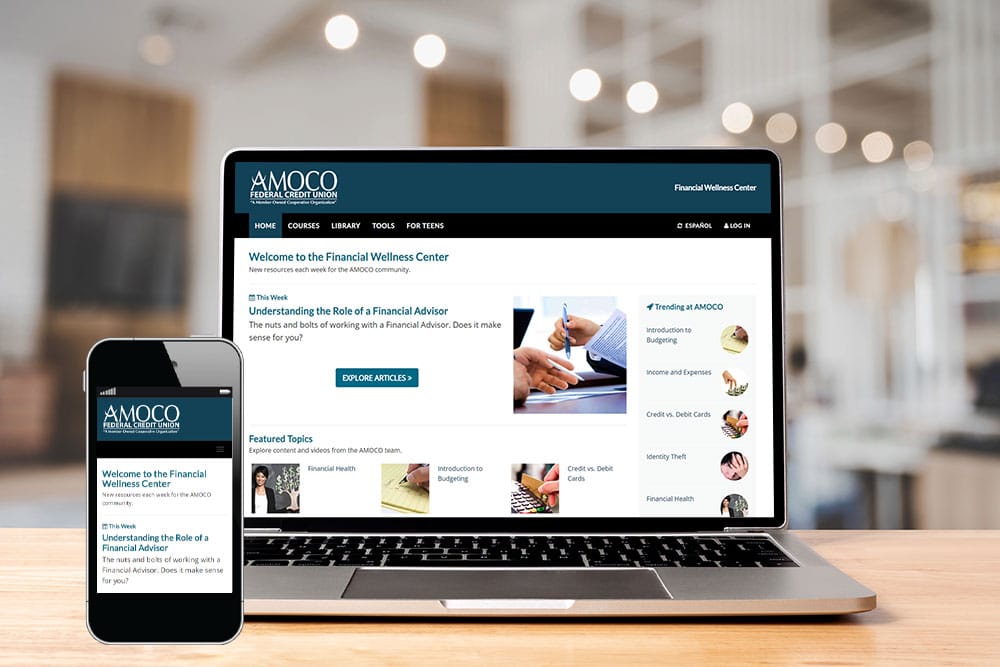

Financial Wellness Education

MoneyEdu

Empower Your Financial Journey

AMOCO has partnered with MoneyEdu to provide free, online financial education through interactive and self-paced courses, activities and worksheets giving members and the community access to financial education. In addition, if you create an account, you can save your progress and never lose your work.

- New themes every week

- Featured resources

- Calculators and assessments

- Interactive courses on over dozens of topics

- Create a portfolio of your goals and achievements

"This Week's" Topics Provided By MoneyEdu

A Seven-Day Plan to Cut Spending

Keeping More of Your Money

Question Your Habits and Save

A Fresh Look at Food Expenses

The True Cost of Subscriptions

Tackling High-Interest Debt

Saving Money With Your Car and Home

Adopting a Money-Smart Mindset

Financial Tools

Auto Loan

Calculator

Want to know how much your new auto loan will cost you? Curious if your budget can afford the new car you’ve been eyeing? Use our Auto Loan Calculator today!

Financial Wellness Center

Access additional personal finance articles and tools through our partner program, MoneyEdu. When you register for a FREE profile, you’ll also receive free financial wellness courses and calculators.

Budget

Calculator

Making a budget and sticking to it is the number one step to having financial freedom. Use this calculator to help you create a monthly budget by entering your monthly take-home pay.