- Save

-

-

What Are You Saving For?

We all know how important saving money is. Whether you’re a dedicated saver or just beginning to build your savings; we offer a variety of safe and secure savings plans to help your money grow.

-

Savings Accounts

-

Open an Account Online

When you join AMOCO Federal Credit Union you begin your membership by opening a basic savings. This account establishes your ownership in the credit union and is the foundation you can build on to achieve your financial goals.

-

-

- Spend

-

-

What Are You Spending For?

Spending money is a daily part of living; however, smart spending allows you to save for your future. At AMOCO, we believe in investing in you and helping you build your nest egg to take care of yourself and your family.

-

Spend Accounts

-

Want Affordable Checking?

We believe that checking should be made simple, so we have one FREE checking account for all of our members. That’s right, no minimum balance requirements, no direct deposit requirements, no monthly service fee and unlimited transactions!

-

-

- Borrow

-

-

What Are You Borrowing For?

Our goal to make your financial dreams come true. Whether you are purchasing your first car, looking for a great credit card or want to own vacation homes, we help you fund your future.

-

Loans

-

Apply for a Loan Online

At AMOCO, we have loans for your wants and needs. We work hard to provide members with high-quality service, lower rates, and flexible payment options so you can get the most for your money.

-

-

- Insure

-

-

Protect What Matters!

Prepare for the unexpected. Our insurance plans can help you save big while offering excellent coverage. Don’t wait until it’s too late – contact us today to learn more about your options.

-

Insurance

-

Explore Coverage Plans

We’ve broadened our insurance offerings by partnering with reputable organizations. Let us help you find the coverage you need for the things that matter most to you. And the best part? You can potentially save hundreds of dollars annually.

-

-

- Invest

-

-

Invest In Yourself!

Plan our financial dreams – from saving for college to planning retirement. We’ll discover where you want to go and how you will get there.

-

Start Investing

-

Manage Your Investments

Through LPL Financial, you have the ability to manage multiple types of investments, access your account anywhere, anytime and partner with a professional to help understand your unique financial situation.

-

-

- ACCESS MY ACCOUNT

- Special Offers

Unlock the Rewards!

Earn reward points on your everyday purchases, and you can redeem them for premium merchandise, travel, gift cards, and more!

Payment Options

Quick and easy ways to pay

your loan and credit card.

Loan Calculator

Use our loan calculator to find

your estimated payment.

Locations

Find branch locations, hours,

and ATMs near you.

Let's Talk

Need to reach us?

We're here to help!

in funded loans

members and counting

would recommend AMOCO to a friend

VOTED

best credit union, financial planning, and mortgage lender

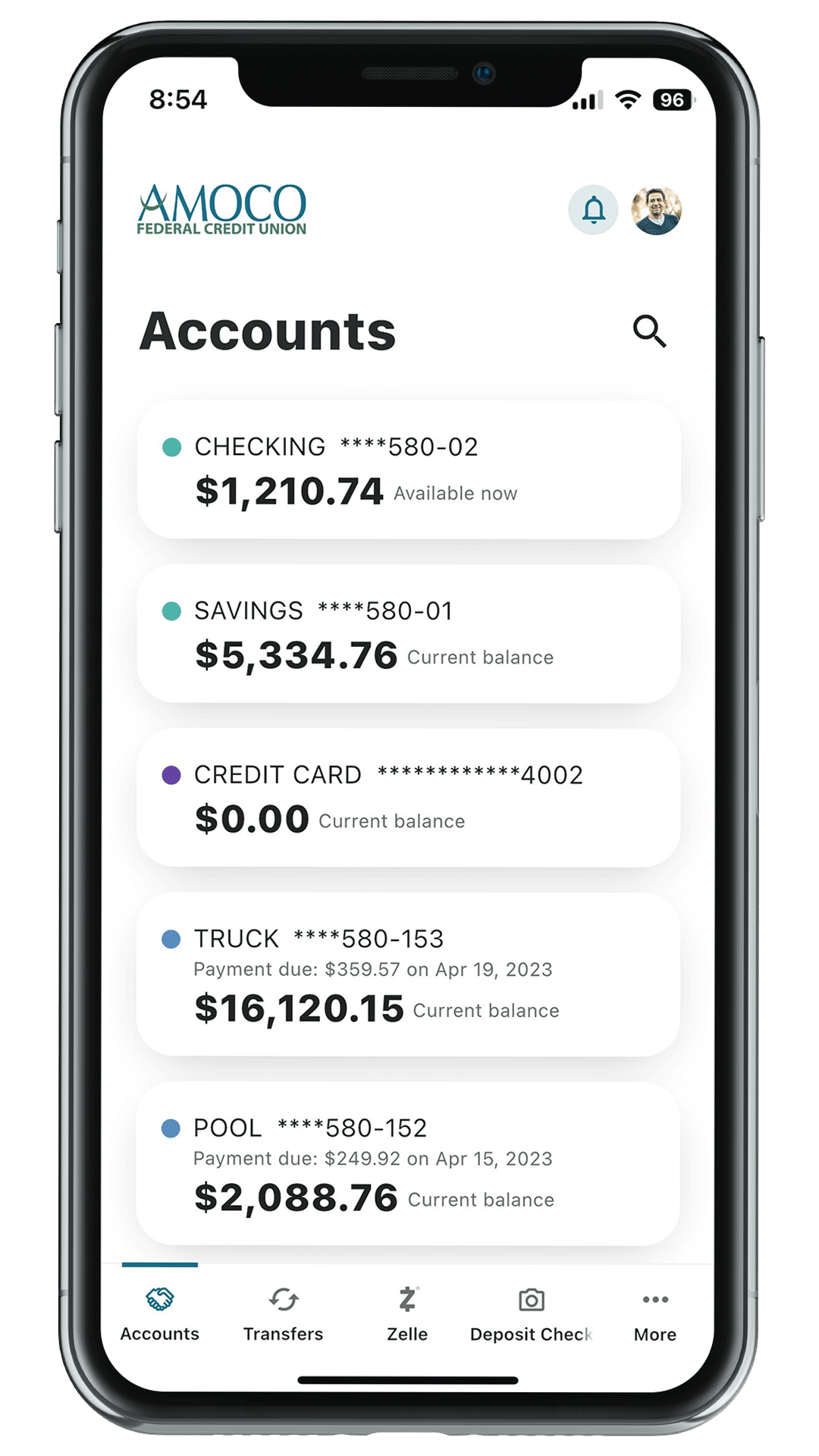

AMOCO Mobile App Features

Custom Account Alerts

What's this $200 withdrawal? Set up custom alerts sent to your phone or email.

Face & Touch Login

Make transactions easy and secure with Face ID, Touch ID, and Fingerprint Authentication (if supported).

Skip-A-Pay

Everyone could use extra funds from time to time, and with our convenient Skip-A-Pay you can instantly take a break from your qualifying loan payment(s) up to two times a year.

Deposit Check(s)

Deposit checks with your mobile device just by taking a picture. You're going to love this feature!

Personal Info & Documents

Stay connected with us and update your personal info on-the-go and access up to 18 months of eStatements.

Services

Easy-to-use Services that Simplify your Life!

Make a Payment

Make a payment from another bank to your loan here.

Manage Accounts

Access your money, check your balance, make a transfer, and more.

Open Account

Open a Savings, Checking, Term Share CD, or apply for a loan.

Invest

We can help you prepare for your future.

Explore Real Estate

Let us help you live in your dream home.

Insurance

We've got you covered with affordable insurance products.

Meet-Ups

Socialize with other members in our fun meet-up groups.

Member Rewards

We reward our members! Because relationships are everything.

Budget

Create a monthly budget to help your money go further.

Financial Education

Members have free access to expertly-crafted financial education and resources.

Perks

Check out our benefits, including discount memberships and more.

Financial Assistance

Unexpected things happen. Let AMOCO help you in your time of financial need.

AMOCO @Work

Here are some of the 600+ companies offering AMOCO at work as a benefit to their employees!